ICMAI CMA Intermediate 2023 for December session will be held from 10 to 17 December 2023 and June session were held from 15 to 22 July 2023. The CMA Inter examination is held twice a year, in June and December, respectively. This is the second stage of the cost and management accounting profession in India offered by ICMAI. Read here for complete information on CMA Inter 2023 like registration process, eligibility, schedule, exam pattern, syllabus, etc., from this page.

Latest – ICMAI CMA Intermediate December 2023 admit card has been released. Get the link to download the admit card here.

Latest – ICMAI CMA Intermediate December 2023 admit card has been released. Get the link to download the admit card here.

ICMAI CMA Inter 2023

About the exam: The CMA Inter examination is held twice a year, in June and December, respectively. This is the second stage of the cost and management accounting profession in India offered by ICMAI. Candidates aspiring to appear in ICMAI CMA Inter 2023, must stay updated with the latest information.

Quick Links

ICMAI CMA Inter 2023 Exam Dates

ICMAI announces the exam date and other important dates of the ICMAI CMA Inter 2023 exam. If you are appearing in the ICMAI CMA Inter exam then check the schedule here.

| CMA Inter 2023 for December Session | Dates |

|---|---|

| Last date to submit the Application Form | As per ICMAI |

| Admit Card Release Date | 01 Dec 2023 |

| CMA Inter 2023 Examination | 10 to 17 December 2023 |

| Declaration of Result | As per ICMAI |

| CMA Inter 2023 for June Session | Dates |

|---|---|

| Last date to submit the Application Form | 15 May 2023 |

| Admit Card Release Date | 07 Jul 2023 |

| CMA Inter 2023 Examination | 15 to 22 Jul 2023 |

| Declaration of Result | 26 Sep 2023 |

ICMAI CMA Inter 2023 Overview

Highlights of the examination are as follows.

| Aspects | Details |

|---|---|

| Name of Exam | ICMAI CMA Inter 2023 |

| Organizing Body | ICMAI |

| Full Form of ICMAI | The Institute of Cost Accountants of India |

| Level of Exam | Second stage exam for become Certified Management Accountant (CMA) |

| Official Website | icmai.in |

| Minimum Educational Qualification | As per eligibility criteria |

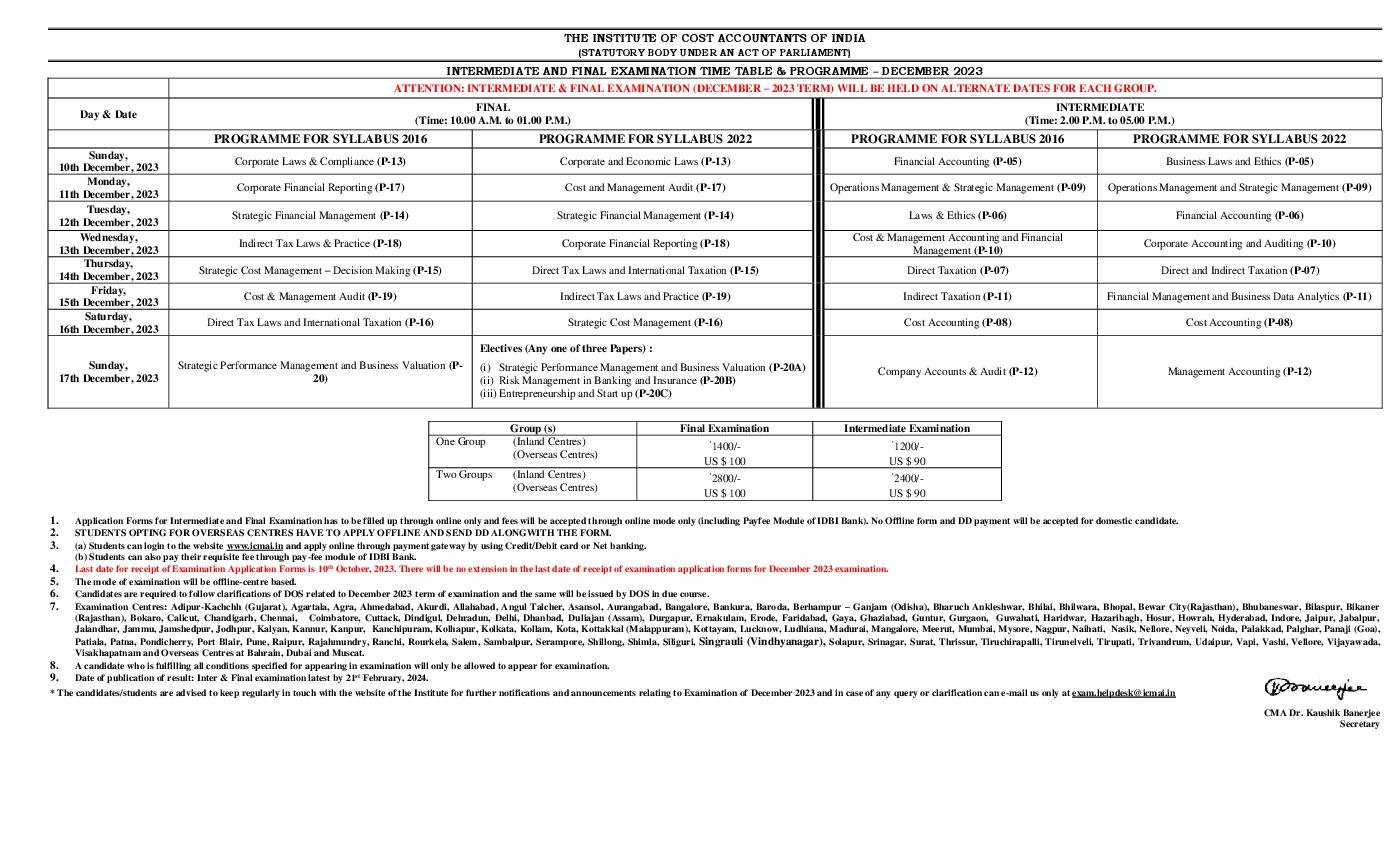

ICMAI CMA Inter December 2023 Exam Schedule Notification

Institute of Cost Accountants of India has released the schedule notification for the Inter Examination of the December 2023 term. Candidates can check the notification below the image.

CMA Inter 2023 Application Form

Any student who wishes to appear in the CMA Inter 2023 needs to first fill up the application form. Important points are as follows.

- ICMAI releases the CMA Inter 2023 Application Form at icmai.in.

- Students should fill and submit the CMA Inter 2023 online application form before the last date.

- In order to apply, one has to do the CMA Inter 2023 registration, then enter details in the online form, upload documents required, and pay the fee.

- Also, only eligible students should apply for the Certified Management Accountant (CMA) exam.

CMA Inter 2023 Eligibility Criteria

Candidates before filling the application form need to check the eligibility criteria. So the complete criteria’s are given below:

- The aspirant should have passed the Foundation Course of the ICMAI and should have cleared 10+2

- Candidates must have qualified the Foundation (Entry Level) Part 1 Examination of Certificate in Accounting Technicians (CAT) Course of the Institute of Cost Accountants of India.

- Degree from any recognized University or must be pursuing Engineering Course or Qualified Engineers or equivalent in any subject other than music, dancing, photography, painting, and sculpture.

ICMAI CMA Inter 2023 Admit Card

- The ICMAI will be released CMA Inter Admit Card 2023 at its official website only for successfully registered candidates.

- The Institute does not send the hard copy of the Admit Card to the candidates by post/ courier.

- To download CMA Inter 2023 Admit Card, candidates need to log in by entering their 12 digit Registration Number.

- The Admit Card consist of details like exam timing, the address of the test center, etc. CMA Inter admit card is issued for only those candidates who submit their CMA Inter Application Form before the last date with complete payment.

- Test takers will not allowed to sit in the examination hall without a valid admit card.

ICMAI CMA Inter 2023 Exam Pattern

ICAI CMA Inter June 2023 comprises two groups. Candidates are required to study the question paper pattern carefully.

- Duration of Examination: 3 hours

- Mode of Examination: Offline-centre based

ICMAI CMA Inter 2023 Examination Centres

Adipur-Kachchh (Gujarat), Agartala, Agra, Ahmedabad, Akurdi, Allahabad, Angul Talcher, Asansol, Aurangabad, Bangalore, Bankura, Baroda, Berhampur – Ganjam (Odisha), Bharuch Ankleshwar, Bhilai, Bhilwara, Bhopal, Bewar City(Rajasthan), Bhubaneswar, Bilaspur, Bikaner (Rajasthan), Bokaro, Calicut, Chandigarh, Chennai, Coimbatore, Cuttack, Dindigul, Dehradun, Delhi, Dhanbad, Duliajan (Assam), Durgapur, Ernakulam, Erode, Faridabad, Gaya, Ghaziabad, Guntur, Gurgaon, Guwahati, Haridwar, Hazaribagh, Hosur, Howrah, Hyderabad, Indore, Jaipur, Jabalpur, Jalandhar, Jammu, Jamshedpur, Jodhpur, Kalyan, Kannur, Kanpur, Kanchipuram, Kolhapur, Kolkata, Kollam, Kota, Kottakkal (Malappuram), Kottayam, Lucknow, Ludhiana, Madurai, Mangalore, Meerut, Mumbai, Mysore, Nagpur, Naihati, Nasik, Nellore, Neyveli, Noida, Palakkad, Palghar, Panaji (Goa), Patiala, Patna, Pondicherry, Port Blair, Pune, Raipur, Rajahmundry, Ranchi, Rourkela, Salem, Sambalpur, Serampore, Shillong, Shimla, Siliguri, Solapur, Srinagar, Surat, Thrissur, Tiruchirapalli, Tirunelveli, Tirupati, Trivandrum, Udaipur, Vapi, Vashi, Vellore, Vijayawada, Vindhyanagar, Visakhapatnam

Overseas Centres at Bahrain, Dubai and Muscat.

ICMAI CMA Inter 2023 Result

Key points related to the ICMAI CMA Inter Result 2023 are as follows.

- The Institute of Cost Accountants of India declares the results on the result date and time decided by them.

- Where to check result – You can get the direct link to check ICMAI CMA Inter result at official website i.e. icmai.in.

- How to check ICMAI CMA Inter result? – To check the result, go to the official website icmai.in and click on the result link. You can check the ICMAI CMA Inter result as score card, rank card, merit list, or rank list depending on what ICMAI publishes.

About ICMAI

The Institute of Cost Accountants of India (erstwhile The Institute of Cost and Works Accountants of India) was first established in 1944 as a registered company under the Companies Act with the objective of promoting, regulating and developing the profession of Cost Accountancy. The Institute of Cost Accountants of India is the only recognized statutory professional organisation and licensing body in India specialising exclusively in Cost and Management Accountancy.

Contact Details

The Official website is icmai.in

To get exam alerts and news, join our Whatsapp Channel.