ICMAI has been released exam dates for ICMAI CMA Foundation, Inter, and Final June 2024 exam. The Intermediate and Final examination is scheduled to be held from 11 to 18 June 2024. Whereas, CMA Foundation exam is going to be held on 16 June 2024. In order to appear for the June Term examinaton, candidates must download their admit card online at icmai.in. Institute of Cost Accountants of India (ICAI), which was previously known as the Institute of Cost and Work Accountants of India (ICWAI). There are three stages to be pursued to become a Cost and Management Accountant. The First stage is the Foundation Course, the second stage is the Intermediate Course and the last stage is the Final course. Candidates after passing the CMA Final exam are eligible for Membership of ICAI. Check complete details of the ICMAI exams from this page.

Latest –

Latest –

– ICMAI has been released Intermediate and Final Examination for June 2024 Term. Check here

– ICMAI has been released Foundation Examination for June 2024. Check here

ICMAI 2024 Exam

About the Exam: Institute of Cost Accountants of India (ICAI) conducts three stages to be pursued to become a Cost and Management Accountant. The First stage is the Foundation Course, the second stage is the Intermediate Course and the last stage is the Final course.

ICMAI 2024 Exam

ICMAI 2024 Dates

ICMAI announces the exam date and other important dates of the ICMAI 2024 exam. If you want to become a Cost and Management Accountant then check the schedule here

| Important Events of ICMAI 2024 | June Session Dates |

|---|---|

| ICMAI 2024 Foundation Course Examination for June Session | 16 June 2024 |

| ICMAI 2024 CMA Inter & Final for June Session | 11 to 18 June 2024 |

ICMAI 2024 Exam Overview

Highlights of the examination are as follows.

| Aspects | Details |

|---|---|

| Name of Exam | ICMAI 2024 |

| Organizing Body | ICMAI |

| Full Form of ICMAI | The Institute of Cost Accountants of India |

| Level of Exam | Entry Level exam for Accountants |

| Official Website | icmai.in |

| Minimum Educational Qualification | As per eligibility criteria |

Who is Cost and Management Accountant (CMA)?

As the officials have stated a Cost and Management Accountant specializes in navigating managerial decisions, stabilizing budgets and standards, assessing operational efficiency and the effectiveness of production and service management. The responsibility of a CMA is to design and implement effective management information and control systems, planning costing systems and methods, inventory control incorporating mathematical models, investment analysis, project management, internal audit, etc in such a way as to guide the core management into taking the right decisions.

The Cost Accountants currently in great demand in the government sector, private sector, banking & finance sector, developmental agencies, education, training & research sector as well as in service and public utility sector.

What are the Job Opportunities for CMA?

The job opportunities for CMA includes the following:

- Cost Accounting, Financial Management

- Financial/Business Analyst, Systems Analysis & System Management

- Auditing, Internal Control

- Tax management

- ERP Implementation

- Process Analysis in BPO Houses

- Implementing Business Intelligence Systems

- Academia-as Faculties

What is ICMAI?

Before the students even proceed to know about the various stages for becoming CMA, one of the important things to know is about the Institute conducting the exam. So let us proceed to know ICMAI and its functions.

As stated before, ICMAI stands for The Institute of Cost Accountants of India. The institute was established on May 28, 1959, under the Cost and Works Accountants Act, 1959 as amended by the Cost and Works Accountants (Amendment) Act, 2006 and Cost and Works Accountants (Amendment) Act, 2011. ICMAI has its headquarters at Kolkata and has 4 Regional offices at Kolkata, Mumbai, Chennai and New Delhi. There are more than 5 lac students and 70000 members (CMAs) serving in different capacities throughout the world.

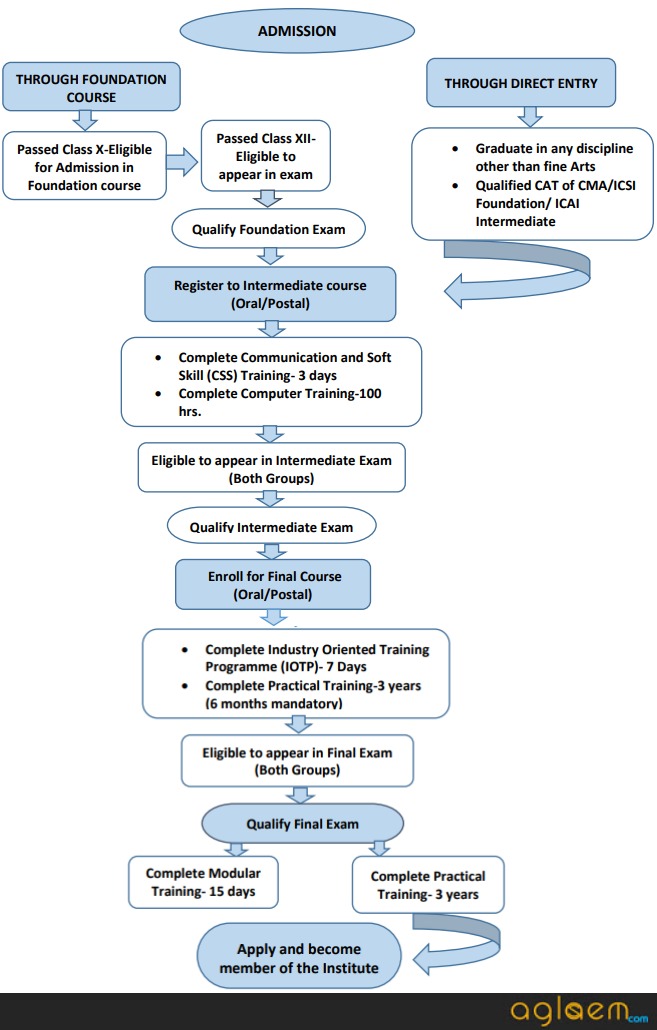

What are the Stages to Become CMA?

There are three (03) stages to become a Cost and Management Accountant, which are:

- CMA Foundation

- CMA Intermediate

- CMA Final

ICMAI Course Eligibility and Course Details

Candidates can check the eligibility and details for all the courses of ICMAI below.

ICMAI Foundation Course Eligibility and Course Details

ICMAI Foundation offers a course Certified Management Accountant (CMA) which will help the candidate to become a certified management accountant. It helps the candidates two develop two important skills which are financial accounting and strategic management. Along with the core strategy, management, and accounting, it also focuses on regulatory. After clearing the foundation course the certificate will tell that the candidate possesses knowledge in the areas of financial planning, analysis, control, decision support, and professional ethics.

Eligibility Criteria for CMA Foundation

Candidates can check the eligibility requirements for CMA Foundation below.

- A candidate should have passed Class 10 or its equivalent from a recognized Board or Institution.

- The aspirant should have passed Senior Secondary Examination under 10+2 scheme of a recognized Board or an Examination recognized by the Central Government as equivalent thereto or has passed National Diploma in Commerce Examination held by the All India Council for Technical Education or any State Board of Technical Education under the authority of the said All India Council, or the Diploma in Rural Service Examination conducted by the National Council of Higher Education.

Subjects in CMA Foundation

Paper 1: Fundamentals of Economics and Management

Paper 2: Fundamentals of Accounting

Paper 3: Fundamentals of Laws and Ethics

Paper 4: Fundamentals of Business Mathematics & Statisti

ICMAI Intermediate Course Eligibility and Details

ICMAI is of twelve (12) months duration which is the second level/the second stage after clearing the foundation course on the path of becoming a Cost Accountant. The ICMAI course involves the study of subjects and topics such as Cost and Management Accountancy, Statistics, Auditing, Tax Laws and Tax Planning, Organization and Management Fundamentals, Accounting, Economics, and Business Fundamentals, etc.

Eligibility Criteria for CMA Intermediate

Candidates can check the eligibility for CMA Intermediate below.

- The student should have passed Senior Secondary School Examination (10+2)and Foundation Course of the Institute of Cost Accountants of India.

- Should hold a Graduation degree in any discipline other than Fine Arts.

- Should have passed Foundation (Entry Level) Part I Examination of CAT of the Institute and Foundation (Entry Level) Part I Examination and Competency Level Part II Examination of CAT of the Institute.

- Should have passed Foundation of ICSI/Intermediate of ICAI by what ever name called along with 10+2.

Subjects in CMA Intermediate

Candidates can check the subjects offered under CMA Intermediate below.

- Paper 5 Financial Accounting

- Paper 6 Laws, Ethics and Governance

- Paper 7 Direct Taxation

- Paper 8 Cost accounting and financial management

- Paper 9 Operation Management Information System

- Paper 10 Cost and Management Accounting

- Paper 11 Indirect Taxation

- Paper 12 Company Accounts & Audit

ICMAI Final

ICMAI is a 12 months course which is minimum duration; also, it is the final level/final stage study before the practical training, on the path of becoming a Cost and Management Accountant. The ICMAI course involves the study of subjects and topics such as Cost and Management Accountancy, Statistics, Auditing, Tax Laws and Tax Planning, Organization and Management Fundamentals, Accounting, Economics, and Business Fundamentals, etc. The course provided by the Institute of Cost and Management Accountants of India (ICMAI) is a mixture of postal tuition and mandatory coaching classes for a specified period. Study material is provided to the students at the time of admission.

Eligibility Criteria for CMA Final

- Should have passed Intermediate Examination of the Institute of Cost Accountants of India.

Subjects in CMA Final

Paper 13- Corporate Laws and Compliance

Paper 14- Advanced Financial Management

Paper 15- Business Strategy & Strategic Cost Management

Paper 16- Tax Management and Practice

Paper 17- Strategic Performance Management

Paper 18- Corporate Financial Reporting

Paper 19- Cost and Management Audit

Paper 20- Financial Analysis & Business Valuation

Admission Process for CMA courses

The flow from admission to the course up to the membership is as follow.

About ICMAI

The Institute of Cost Accountants of India (erstwhile The Institute of Cost and Works Accountants of India) was first established in 1944 as a registered company under the Companies Act with the objects of promoting, regulating and developing the profession of Cost Accountancy.

Objectives of the Institute

- To develop the Cost and Management Accountancy function as a powerful tool of management control in all spheres of economic activities.

- To promote and develop the adoption of scientific methods in cost and management accountancy.

- To develop the professional body of members and equip them fully to discharge their functions and fulfill the objectives of the Institute in the context of the developing economy.

- To keep abreast of the latest developments in the cost and management accounting principles and practices, to incorporate such changes are essential for sustained vitality of the industry and other economic activities.

- To exercise supervision for the entrants to the profession and to ensure strict adherence to the best ethical standards by the profession.

- To organize seminars and conferences on subjects of professional interest in different parts of the country for cross-fertilization of ideas for professional growth.

- To carry out research and publication activities covering various economic spheres and the publishing of books and booklets for spreading information of professional interest to members in industrial, education and commercial units in India and abroad.

Contact Details

The Official website is icmai.in

To get exam alerts and news, join our Whatsapp Channel.